Ethereum Loses 'Deflationary' Title - #2 Cryptocurrency Hit With INFLATION For First Time...

Ethereum just lost one if it's biggest bragging points, and its transition from a deflationary to an inflationary asset marks a potentially pivotal moment in its trajectory. While the platform continues to be a dominant player in the decentralized finance (DeFi) space, these economic and market shifts warrant close observation by investors and stakeholders.

What Happened?

Ethereum's shares the most common cause of currency inflation with governments around the world, specifically when they print too much money. There have been 68,000 new ETH issued, compared to its burning 38,000 ETH over the last 30 days - add this excess together with a bearish month, and the additional supply enters the ecosystem as inflation.

Ethereum has a system where a portion of the transaction fees (or "gas") is burned, reducing the overall supply of ETH, while another portion compensates validator nodes.

Typically this causes ETH to be deflationary - that is, when network activity is stronger, the amount of ETH burned can surpass the amount issued.

Some Perspective...

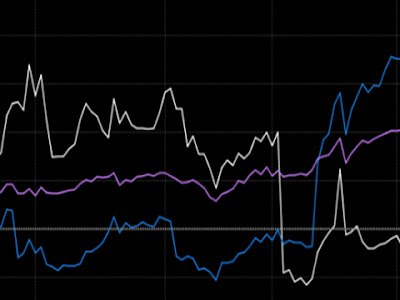

It's crucial to note that Ethereum's annual inflation rate remains relatively subdued at 0.3%, especially when compared to Bitcoin's 1.6% and certain fiat currencies, which hover around 3.7%.

Bitcoin has been categorized as inflationary due to its capped supply of 21 million coins and the halving of its block rewards approximately every four years, which restricts its issuance and, by extension, its inflationary potential. In contrast, fiat currencies, like the US dollar, can be issued without an upper limit, leading to inflation when the supply outpaces demand.

So, while 0.3% is an insignificant amount and there's no need for investors to modify their outlooks, yet, this is something worth keeping an eye on. Unless hit with large downturn (which I haven't seen anyone predicting) Ethereum can re-take it's 'deflationary' title fairly easily.

Plus, For the First Time in YEARS - Ethereum Users Didn't Pay the Most in Total Transaction Fees...

Another interesting thing stood out when reviewing Ethereum's previous month - a significant drop in total transaction fees. After 3+ years embarrassingly high, sometimes absurd fees - this is a good thing.

In the last 30 days, the Tron network generated $87.4 million in fees and $65.8 million in token incentives, resulting in net profits of $21.6 million. Ethereum, on the other hand, generated $82.2 million in fees but offered token incentives of $82.9 million, leading to losses of $20.6 million. "There's a lot of projects taking direct aim at Ethereum, with their main goal being to transfer some of ETH's market share to themselves' said one blockchain consultant on Reddit.

Other platforms including Lido Finance ($46.9 million), friend-tech ($30 million), Bitcoin ($27 million), Uniswap ($23 million), Aave ($8.8 million), and BNB Chain ($ 8 million), surpassed Ethereum in generating fees.

-----------

Author: Ross Davis

Silicon Valley Newsroom

GCP | Breaking Crypto News